New research from Morguard indicates Canada’s multi-unit residential sector remained resilient during Q2 2020, as did the industrial sector. While the office leasing market softened between April and June, and the retail property segment struggled due to imposed closures to contain COVID-19, the industrial and multi-suite residential segments performed at healthy levels.

“The economic slowdown resulting from the pandemic impacted the commercial real estate sector and investor decisions during the second quarter of 2020,” said Keith Reading, Director, Research at Morguard. “Canada’s economic recovery from the downturn is expected to unfold with a large degree of unevenness in the second half of 2020 as local governments take a phased approach to reopening with caution.”

The multi-suite residential segment continued to be a solid investment during this period, as it provided much needed rental housing to Canadians. In the midst of the pandemic the percentage of rent payments remained stable, which may have been impacted by the federal government’s Canada Emergency Response Benefit (CERB) that helped many Canadians directly affected by COVID-19 to gain financial support.

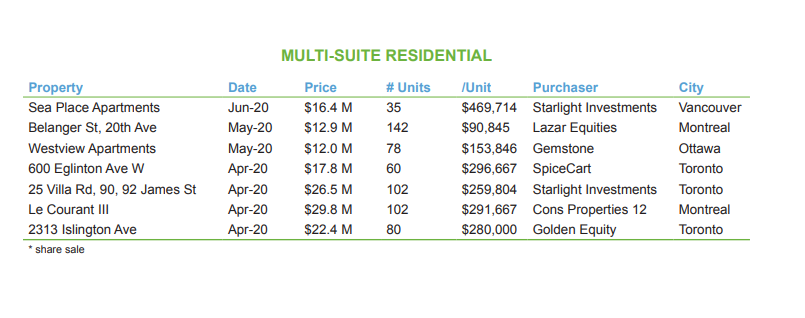

Notable Q2 2020 transactions

In the latter half of the second quarter, Canada’s job market came back to life following an unprecedented decline as a result of the pandemic. At the end of June, total unemployment rested 1.8 million below the February levels but, despite the shortfall, June’s spike was stronger than expected.

“Consumer spending has been a major driver of Canada’s economic growth for some time,” said Reading. “We expect the economy to begin to recover in the second half of 2020. An important contributor to the recovery will be the role businesses play in strengthening consumer confidence by putting safety first in order to facilitate a return to brick and mortar shopping and entertainment. In an ideal scenario, the spending habits of Canadians will return to pre-pandemic levels, in support of the recovery of jobs, especially in the services industry.”

Lower oil prices and global demand will hamper economic progress in Alberta, Saskatchewan and Newfoundland and Labrador. Conversely, British Columbia, Manitoba and New Brunswick are forecasted to recover more quickly given relatively lower levels of exposure to COVID-19 and earlier economic re-openings.

The full report is available at morguard.com/research.