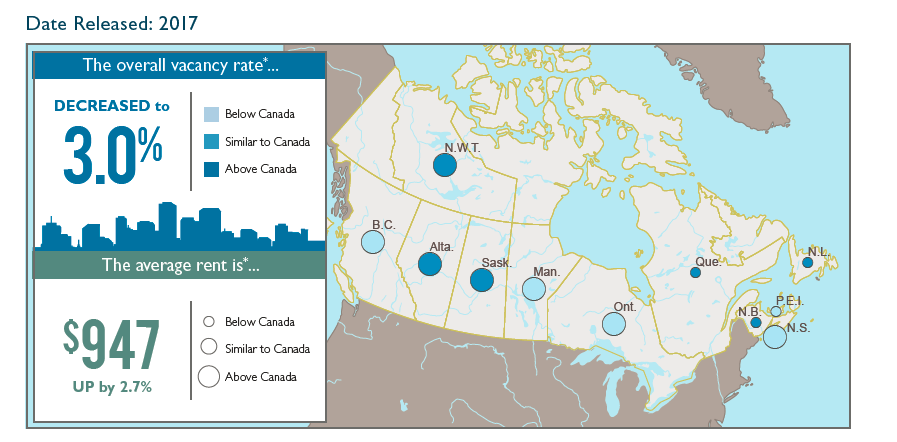

According to CMHC’s 2017 Rental Market Survey, the average vacancy rate for purpose-built rental apartment units across all surveyed centres decreased from 3.7 per cent in October 2016 to 3.0 per cent in October 2017. During the same timeframe, the number of purpose-built rental apartments increased by approximately 23,000 units, or 1.2 per cent. This represents a significant slowdown in the growth of supply when compared to the roughly 40,000-unit increase registered between October 2015 and October 2016.

“Nationally, increased demand for purpose-built rental apartment units outpaced growth in supply, leading to a decline in the vacancy rate and a reversal of the trend we’ve seen over the last two years,” said Gustavo Durango, Senior Market Analyst at CMHC. “Demand for purpose-built rental apartments can be attributed to historically high levels of positive net international migration, improving employment conditions for younger households and the on-going aging of the population.”

As mentioned, new international migrants are a key source of rental housing demand because they have a strong tendency to rent during the first few years of their arrival, when compared to non-migrants and migrants who have been in Canada longer. While Canada saw a decline in the number of net new immigrants over the first half of 2017 compared to the same period in 2016, 2016 saw a near-record high level of new immigrants. As a result, the level of net international immigration to Canada remains well-above historical averages, thus providing a strong level of support for rental demand.

Younger households and aging Canadians are also affecting rental demand. While younger households tend to have lower incomes and are more likely to gravitate towards renting, the growing aging population is contributing to the increase in occupied rental units.

Provincial highlights

Rental housing demand increased in most regions of Canada, including the oil-producing province of Alberta, which saw a meaningful decline in its vacancy rate following two years of sharp increases in the wake of the 2014 oil-price shock. In a sign of economic recovery, the vacancy rate in Alberta has declined to 7.5 per cent from 8.1 per cent a year ago.

Most provinces saw an increase in demand for purpose-built rental apartments, as indicated by increases in the number of occupied units between October 2016 and October 2017. The largest gain in the number of occupied rental units was reported in Ontario, followed by Quebec. These provinces also saw some of the strongest gains in the supply of new purpose-built rental apartment units, but this was outpaced by demand growth.

In Ontario, the vacancy rate fell from 2.1 per cent in October 2016 to 1.6 per cent in October 2017, while Quebec registered a decline from 4.4 per cent to 3.4 per cent over the same period. Ontario and Quebec have both seen improvement in employment conditions so far in 2017, including growth in the employment of 15- to 29-year-olds. They also continue to receive relatively high levels of international migrants, despite registering a year-to-date decline from levels in 2016.

In the Atlantic region, generally modest employment growth and relatively high levels of net international migration supported growth in rental demand. This led to declines in vacancy rates in Prince Edward Island (from 2.1% in October 2016 to 1.2% in October 2017), Nova Scotia (from 3.0% to 2.6%) and New Brunswick (from 6.6% to 4.1%). Newfoundland and Labrador was the only province that registered essentially no growth in the number of occupied units.

Manitoba and Saskatchewan saw relatively modest gains in the growth of occupied units that nonetheless outpaced growth in supply. On balance, this led to a very slight 0.1 percentage point decline in the vacancy rate in both provinces, from 2.8 per cent to 2.7 per cent in Manitoba and from 9.4 per cent to 9.3 per cent in Saskatchewan.

Average rents

The average rent across all surveyed centres for two-bedroom apartments in structures common to both the 2016 and 2017 surveys rose by 2.7 per cent. By comparison, inflation in Canada was 1.4 per cent during this 12-month period.

The largest increases were registered in British Columbia, led by Kelowna (8.6%), Victoria (8.1%) and Vancouver (6.2%). Strong increases were also recorded in Ontario, mainly within the Greater Golden Horseshoe region.

Turnover rates

Turnover rates represent the share of units in a purpose-built rental apartment structure that were rented to new tenants in the past 12 months (at the time of the survey). Across surveyed centres, the average turnover rate stood at 20 per cent, essentially unchanged from the rate of 20.2 per cent recorded in October 2016. Turnover rates were above the national average in Saskatchewan, Alberta, Manitoba, New Brunswick and Nova Scotia and below the national average in British Columbia, Ontario, Quebec, P.E.I., and Newfoundland and Labrador.

Major market facts

- Toronto’s primary vacancy rate reached a 16-year low at 1.0 per cent. Homeownership affordability concerns kept more households in rental. Supply of new private purpose-built rental units was insufficient to meet growing demand. Condominium apartments continued to act as the de-facto new rental accommodation supplier.

- Despite record construction of new units in Vancouver, strong demand for rental accommodation kept the vacancy rates below 1 per cent for both primary rental apartments and rental condominium apartments. The rapid increase in entry-level home prices and higher migration to the region have contributed to rental demand.

- Due to strong demand, the vacancy rate in the Montréal area decreased in 2017 to 2.8 per cent. The change in the average rent was about 2 per cent.

- After increasing for three consecutive years, the apartment vacancy rate in Calgary declined in 2017 to 6.3 per cent. In Edmonton, it remained unchanged at 7 per cent.

- Kelowna and Abbotsford-Mission (both at 0.2%), Victoria (0.6%) and Vancouver (0.9%), Kingston (0.7%) and Toronto (1.0%), have the lowest purpose-built rental vacancy rates.

- Saskatoon (9.6%), Regina and Edmonton (both at 7.0%) and St. John’s (7.2%), have the highest purpose-built rental vacancy rates.

For the complete CMHC 2017 Rental Market Survey, visit: https://www.cmhc-schl.gc.ca/en/hoficlincl/homain/stda/