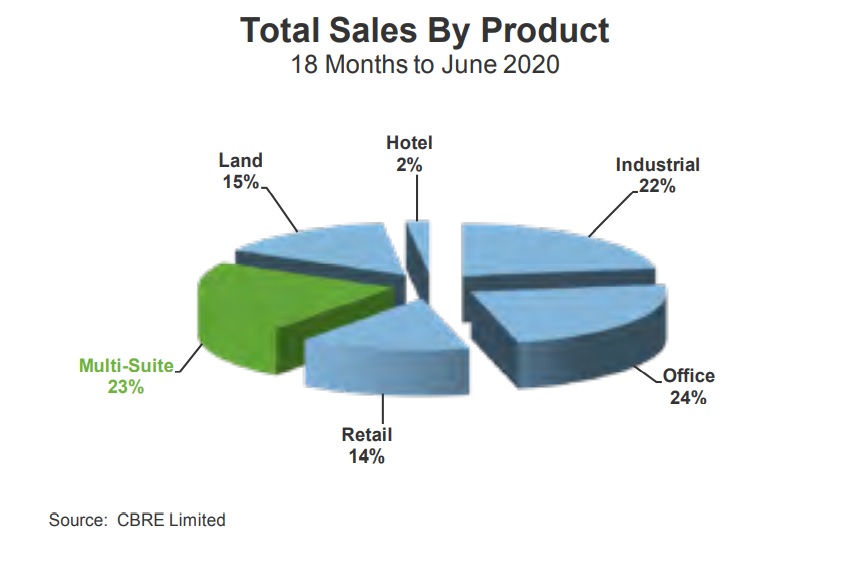

Investor confidence in the multi-suite residential and industrial property sectors remained robust throughout 2020, according to Morguard’s new Canadian Economic Outlook and Market Fundamentals Report. Meanwhile, sales of retail and office property softened as a result of heightened sector uncertainty.

For 2021, Morguard forecasts investors will continue to approach investments with caution while monitoring the national economic recovery.

“The outperformance of industrial and multi-suite residential assets was driven in part by relatively stable rental fundamentals, boosted by demand for warehouse and logistics space and government transfer payments to renter households, respectively.” said Keith Reading, Director, Research at Morguard. “Investors will continue to tread carefully with regard to acquisitions in 2021, given a heightened level of uncertainty surrounding the economic outlook.”

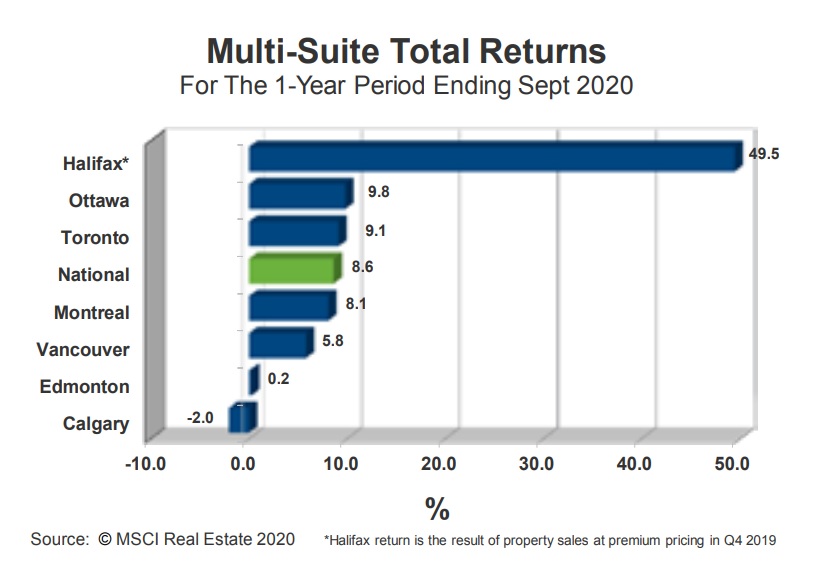

Multi-suite residential

Despite the uncertainty surrounding the effects of COVID-19, investor confidence in the multi-suite residential segment was maintained, resulting in the segment’s healthy investment activity levels following the trend seen over the past several years. Over $3.9 billion in transaction volume was reported during the first six months of 2020, comparable to the record-high $4.0 billion in sales tallied in the first six months of 2019.

A reduction in rental demand resulted in increased vacancy compared with the pre-pandemic record lows reported in several cities and submarkets. The segment is expected to experience a steady recovery in tandem with the anticipation and distribution of a COVID-19 vaccine that will ease restrictions for physical distancing, and as a result, boost rental demand.

Other commercial real estate sectors

The industrial segment showed a significant level of resilience in 2020. The national availability rate stood at a healthy 3.5 per cent by the end of September 2020, up slightly from the record low 2.9 per cent reported in September 2019. Increased online shopping and demand for delivery and logistics services supported the segment’s outperformance when compared with retail and office real estate.

Investment demand remained healthy during 2020, as institutional and private capital investment groups were attracted by the segment’s durability through the pandemic-driven economic downturn. Looking ahead, strong e-commerce-related activity and a gradual economic recovery will continue to boost demand in the industrial segment in 2021.

The retail segment continued to adapt to industry change and COVID-19-related restrictions in 2020. The closure of non-essential stores throughout the first and second waves of the pandemic resulted in significant losses of revenue for business owners, who pivoted to e-commerce platforms and various curbside and delivery strategies to generate sales revenue. New shopping dynamics and lockdowns across the country in the fall of 2020 led to additional brick-and-mortar store closures, adding to the upward vacancy trajectory. During the first six months of 2020, $2.1 billion in retail property sales volume was recorded in the country’s largest urban centres combined, down 30.6 per cent from the same time period a year earlier. Going forward, managing to increase vacancy and adapting to tenants’ changing needs will continue to represent key challenges for landlords. Retail redevelopment, changes to the tenant mix, the introduction of more service retail and the consideration of alternative uses are expected to continue in 2021.

Following an extended period of healthy performance, the office segment softened throughout 2020 due to the economic contraction and work-from-home dynamics brought on by COVID-19. The decline in economic activity eroded private-sector confidence, resulting in the delay or cancellation of expansion plans and leasing-related decisions. Some organizations reduced their office space footprints and looked to offload space in the sublease market in order to reduce costs. During the first six months of 2020, $3.0 billion of office property was sold in the major Canadian urban centres combined, down 46.0 per cent from the same time period a year earlier. Leasing market conditions will soften over the near term, during a period of gradual economic recovery.

Following an extended period of healthy performance, the office segment softened throughout 2020 due to the economic contraction and work-from-home dynamics brought on by COVID-19. The decline in economic activity eroded private-sector confidence, resulting in the delay or cancellation of expansion plans and leasing-related decisions. Some organizations reduced their office space footprints and looked to offload space in the sublease market in order to reduce costs. During the first six months of 2020, $3.0 billion of office property was sold in the major Canadian urban centres combined, down 46.0 per cent from the same time period a year earlier. Leasing market conditions will soften over the near term, during a period of gradual economic recovery.

Economic factors

Efforts from the federal government and Canada’s central bank to support Canadian households and businesses during COVID-19 led to an economic rebound from the historic decline at the beginning of 2020. Meanwhile, the Bank of Canada implemented cuts to the overnight interest rate to offset the negative impacts of the pandemic on Canada’s businesses and consumers. These measures bolstered consumer confidence levels, resulting in increased levels of spending during the summer and early fall of 2020.

By the end of September 2020, more than two-thirds (76 per cent) of the job losses suffered as a result of the pandemic lockdown had been recovered. The optimistic employment landscape in early fall was a by product of the reopening of non-essential businesses after the first wave of the pandemic. Despite this strengthening, Canada’s labour market remained weak in 2020 when compared to the pre-pandemic period. More than 700,000 people remained on layoff at the end of September and youth employment stood below pre-pandemic levels.

Canada’s labour market is expected to strengthen at a moderate pace in 2021. The pace at which the country’s economy recovers will be relatively slow, given an increase in the number of COVID-19 infections and the targeted lockdowns that began in the fourth quarter of 2020.

About the report

The 2021 Canadian Economic Outlook and Market Fundamentals Report is a detailed analysis of the 2021 real estate investment trends to watch in Canada. The full report, including analysis for the real estate markets in Halifax, Montreal, Ottawa, Toronto, Winnipeg, Regina, Saskatoon, Calgary, Edmonton, Vancouver and Victoria is available at morguard.com/research.