Despite the unprecedented challenges of 2020 and 2021, the GTA rental market effectively rebounded by the end of Q4 with rental construction increasing to more than a 30-year high. According to a new report from Urbanation, the average vacancy rate fell back below 3 per cent in all property types in Q4, while purpose-built rental apartments completed since 2005 saw a decline of 2.4 per cent—down from 5.7 per cent a year ago.

In the former City of Toronto, vacancy rates returned to a balanced level of 3.1 per cent after reaching 7.4 per cent in Q4-2020 and 9.0 per cent in Q1 of 2021. In the outer-416 regions (Scarborough, Etobicoke, and North York) and 905 GTA markets, vacancy rates effectively returned to pre-pandemic levels at 2.3 per cent and 1.1 per cent respectively.

“The GTA rental market downturn that occurred during 2020 as a result of the initial effects of COVID-19 quickly reversed in 2021,” said Shaun Hildebrand, President of Urbanation. “While an expected record high for condominium completions and a multi-decade high for purpose-built rental completions in 2022 may help to keep some level of balance in the market this year, expect rents to continue growing on record high immigration, rising incomes, and low homeownership affordability.”

In the case of the 905 region, vacancy never rose above 2 per cent during the pandemic. The incentives in place since the pandemic began have been effective for rental operators, but they became less necessary as the market tightened and shifted back towards a landlord’s market. Less than half (47 per cent) of surveyed purpose-built rental buildings were offering some type of financial incentive to new tenants in Q4-2021, down from a 70 per cent share a year ago.

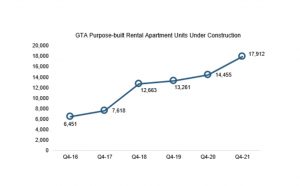

Meanwhile, purpose-built rental apartment development rose to its highest level in decades as 6,720 units started construction in 2021, nearly doubling the five-year average of 3,379 starts between 2016 and 2020. As of year-end 2021, 17,912 rentals were under construction and 93,321 rentals were proposed for development.

Meanwhile, purpose-built rental apartment development rose to its highest level in decades as 6,720 units started construction in 2021, nearly doubling the five-year average of 3,379 starts between 2016 and 2020. As of year-end 2021, 17,912 rentals were under construction and 93,321 rentals were proposed for development.

Rental Demand Shifts Back Into the Core

Total condo apartment lease transactions in the GTA rose 24 per cent in 2021 to a record 47,737 units. As a result, total active rental listings at year-end dropped 73 per cent from a year earlier to 2,158 units, equal to only 0.7 months of supply based on Q4 lease volume. The downtown markets were the growth leaders last year, with lease activity up 27 per cent annually in 2021 within the former City of Toronto.

Furthermore, rental activity once again favoured small units, as lease volume in 2021 grew fastest for rentals under 600 sf with 29 per cent annual growth.

Condo Rent Growth Rises into Double Digits

Condominium rents for leases signed during Q4-2021 rose 10.8 per cent year-over-year to an average of $3.27 per square foot ($2,361), led by a 15.9 per cent annual increase in the former City of Toronto to $3.64 psf ($2,456). Rents in the outer-416 markets increased 8.9 per cent annually to $3.03 psf ($2,277), while 905 region rents were up 9.4 per cent to $2.95 psf ($2,282).

GTA rents were down 3.5 per cent when compared to the pre-pandemic average in Q4-2019, with City of Toronto rents down 4.5 per cent but 905 region rents growing 4.1 per cent over the two-year period. The rent recovery over the past year was strongest for studios units, which increased 15.9 per cent annually in Q4- 2021 to an average of $4.31 psf ($1,771), compared to annual growth of 12.5 per cent for one-bedrooms to an average of $3.44 psf ($2,117), 9.6 per cent for two-bedrooms to an average of $3.08 psf ($2,741) and 6.3 per cent for three-bedroom units to an average of $2.80 psf ($3,382).

For more infomration, please visit Urbanation.ca