While average rents for all GTA rental units available for lease in Q1-2023 reached record highs, smaller units saw a significant surge, according to new data from Urbanation.

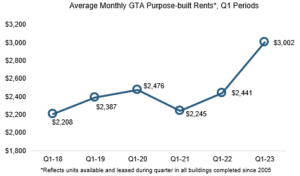

In terms of purpose-built rental buildings, average rents reached highs of $3,002. Annual rent growth for purpose-built rentals in Q1-2023 was 13.8 per cent based on units that turned over in Q1-2023 compared to Q1-2022. This represented a slower rate of annual rent increase than recorded in Q4-2022 at 15.1 per cent.

Within the condominium market, average transacted rents reached $2,741 in Q1-2023, with similar annual growth as purpose-built rentals at 13.6 per cent. In the three-year period since Q1-2020, average condominium rents increased by a total of 15 per cent, which accounts for rent declines that occurred during the first year of the pandemic.

Rents for studio and one-bedroom condo rentals averaged $2,124 and $2,484, while two-bedroom rents averaged $3,125.

“The GTA rental market remained substantially undersupplied during the first quarter of 2023,” said Shaun Hildebrand, President of Urbanation. “Even though supply is set to increase in the near-term, it is expected to be short-lived and insufficient to offset demand. The fact that rental construction has dropped by over 60 per cent in the last year despite rents having risen to over $3,000 is indicative of the economic challenges developers are facing.”

“The GTA rental market remained substantially undersupplied during the first quarter of 2023,” said Shaun Hildebrand, President of Urbanation. “Even though supply is set to increase in the near-term, it is expected to be short-lived and insufficient to offset demand. The fact that rental construction has dropped by over 60 per cent in the last year despite rents having risen to over $3,000 is indicative of the economic challenges developers are facing.”

Renters in the condominium market shifted towards smaller units that have lower monthly costs. As a result, units under 500 square feet saw rents rise by 21 per cent compared to a year ago, while studios and one-bedrooms-without-dens increased by 17.8 per cent and 17.1 per cent respectively. The only category offering rents under $2,000 per month was micro units (i.e., units less than 350 square feet).

Vacancy Rate Under 2% for fifth straight quarter

The vacancy rate in purpose-built rental buildings completed in the GTA since 2005 was 1.8 per cent in Q1-2023, edging up slightly from a year ago in Q1-2022 (1.6 per cent) but remaining below 2 per cent for the fifth consecutive quarter. The GTA rental market has tightened due to record high population inflows, low homeownership affordability, and a strong labour market all contributing to an increase in demand while supply has remained low. In Q1-2023, a total of 724 new purpose-built rentals reached occupancy, falling below the quarterly average of 794 completions over the past two years.

Rental completions set to rise

According to projected occupancy dates, purpose-built rental completions will increase significantly during the remainder of the year, raising the 2023 total to 7,520 units — a 174 per cent increase over 2022 (2,747 completions) and a 297 per cent increase over the latest 10-year average (1,893 completions). That said, the increase in supply is expected to be temporary, as construction starts totaling 2,997 units over the last four quarters represented a 62 per cent decline over the four-quarter total of 7,863 starts in the period ending Q1-2022.

Visit www.urbanation.ca for more info.