Rent growth continues to accelerate in Canada’s apartment market as the economy outperforms expectations and rapid population growth produces demand that exceeds new supply. As per the latest Canadian National Multifamily Report from Yardi, released July 2023, the national average in-place rent increased by $20 in Q2 2023 to an all-time high of $1,431, while new leases not limited by rent control increased more rapidly.

“New apartment supply is expanding, but not enough to meet the needs of the record population growth,” the report contends, adding that Canada’s population is growing at a robust pace—up more than 1 million (2.7%) in 2022 with 505,000 new permanent residents expected by the end of 2023.

And the economy is proving resilient. In Q1 2023 Canada’s GDP rose by 0.8 per cent and 3.1 per cent year-over-year and total employment has exceeded pre-pandemic totals by 500,000 jobs.

Rent growth by CMA

Rent growth by CMA

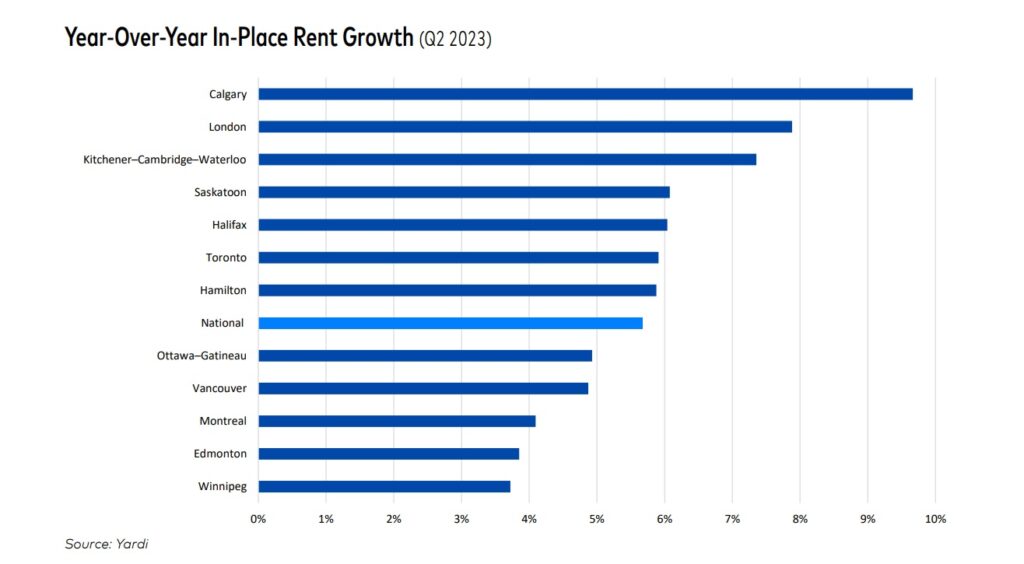

In-place rents, which represent an aggregation of all rents in a given Census Metropolitan Area (CMA), including those for new leases, renewals, and existing leases, grew strongly across Canada in Q2 2023. The city of Calgary led the way, where the average rent rose $47 to $1,387, up 3.5 per cent from the first quarter and 9.7 per cent year-over-year.

Winnipeg saw the slowest rent growth, with average rents increasing $10 to $1,327, up 0.8 per cent for the quarter and 3.7 per cent year-over-year. Among the provinces, Saskatchewan led gainers, with the average rent increasing $27 in the quarter to $1,215, up 6.8 per cent year-over-year.

A key factor pushing rent growth in Canada is the persistent lack of housing supply, which isn’t keeping up with the rapid population growth. Although Canada added about 220,000 new housing units in 2022 (including 115,000 apartments), it still isn’t enough to house the additional one million new residents. According to a recent report on purpose-built rental properties by Canada’s Building Industry and Land Development Association and banking and policy groups, more than 300,000 new renter households will be created in Canada over the next decade.

“Rentals are better suited than homeownership to the fastest-growing demographic groups in Canada,” the group asserts. “Apartment supply, however, gets built slowly due to construction costs that are rising faster than rents and regulatory overreach.”

Over the last decade, purpose-built rentals accounted for 41 per cent of the demand for housing but only 9 per cent of new supply in the GTA, while 90 per cent of the region’s rental stock is at least 40 years old.

In terms of new leases (i.e. units that are re-leased after becoming vacant), Yardi notes that rent growth rose by 12.2 per cent year-over-year in Q2 2023, up 40 basis points from Q1. It also notes that lease-over-lease growth rates have increased for nine straight quarters since bottoming at 3.4 per cent in Q1 2021.

According to Yardi, “The acceleration in rent gains reflects the fact that housing supply is not meeting the growth in population and conditions in the single-family market that create difficulties, especially for first-time buyers. The increase in mortgage rates over the last 16 months has made buying houses less affordable.”

Eight of the 12 CMAs measured by Yardi recorded lease-over-lease growth of at least 11.9 per cent year-over-year, with the highest growth in Toronto (18.7%), Kitchener–Cambridge– Waterloo (17.1%) and Vancouver (16.0%).

Among the provinces, Alberta (10.0% in Q2 2023 from 2.4% in Q2 2022), Saskatchewan (9.2% from 2.1%) and Nova Scotia (15.9% from 9.1%) recorded large year-over-year increases. Growth was lowest in Winnipeg (3.0%), Montreal (6.0%) and Edmonton (7.2%).

More report highlights :

More report highlights :

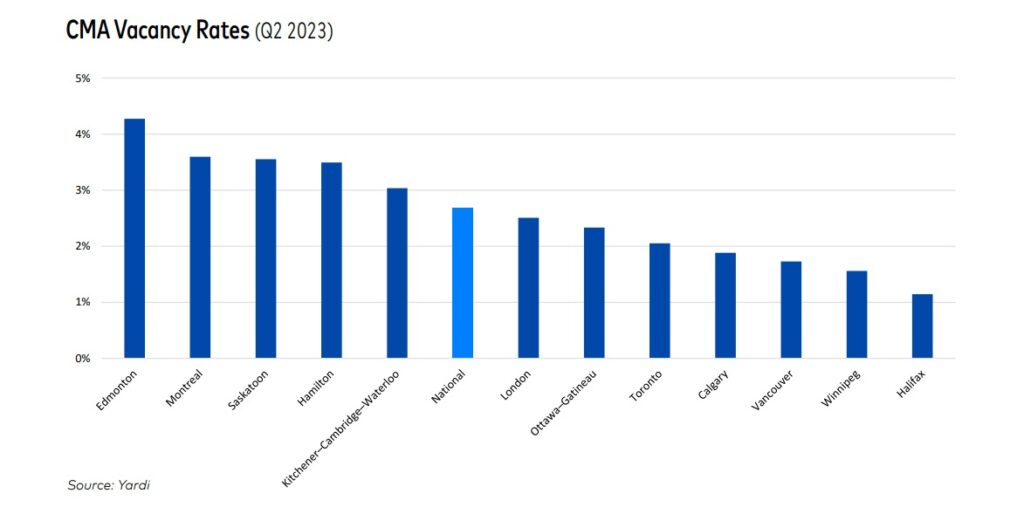

- With housing in scarce supply, vacancy rates are stabilizing at extremely low levels. The national vacancy rate decreased by 10 basis points to 2.7% in Q2 2023, the fourth straight month below 3.0%.

- The national quarterly turnover percentage, which measures the number of residents that do not renew leases, remained low at 6.7% in Q2 2023. Al[1]though that is an increase from the first quarter, the Q2 2023 rate is below the average 7.4% turnover rate in the previous three second quarters.

- Many residents simply cannot afford to move. The gap between rates for newly rented apartments and existing rents continues to widen, representing 25% or more in large urban centres including Toronto, Montreal and Vancouver. In Toronto and Vancouver, CMAs with the highest cost of rental housing, the gap is roughly $500 per month, according to the CMHC. The effect is keeping renters in place because moving to a different apartment inevitably produces a large increase in rents. This is reflected in the low rate of quarterly turnover in Ontario (4.2% in Q2 2023), led by Toronto (3.2%), which remains the primary landing spot for many immigrants entering the country.

- Turnover percentage is closer to historical norms in Alberta (10.5% in Q2 2023) and the largest CMAs in the province, Edmonton (10.7%) and Calgary (9.4%). Alberta has no rent control and housing stock is more abundant than in other provinces. Calgary’s stock is also boosted somewhat by a program to convert vacant downtown office buildings to apartments.

- Vacancy rates are below 2.0% in four CMAs: Halifax (1.1%), Winnipeg (1.6%), Vancouver (1.7%) and Calgary (1.9%). CMAs in which vacancy rates decreased the most year-over-year include Montreal (3.6% in Q2 2023 from 6.1% in Q2 2022) and Winnipeg (1.6% from 3.0%).

Download the full report here: Yardi Canada | Multifamily Market Reports