Renovations or retrofits to an investment property that increase rents and/or decrease operating costs may also increase a property’s value. Cost and value, however, are not synonymous, and not all renovations are as profitable as one might expect.

The term ‘retrofit’ is a fairly broad term that includes capital expenditures that:

a) Extend the useful economic life of the property (i.e. replacing the roof, boiler, etc.);

b) Reduce operating costs (i.e. utilities, water, insurance, etc.); and/or

c) Add new features or amenities to the property (i.e. dishwashing machine, in-suite laundry, etc.).

In theory, a retrofit should be completed when the incremental value created by the retrofit exceeds the present value of its cost. Let’s break this down.

How do we estimate value?

There are three primary approaches to estimating value of commercial properties, such as multifamily apartments:

1) The Direct Comparison Approach;

2) The Cost Approach; and

3) The Income Approach.

For multifamily apartment building valuations, the Direct Comparison and Cost Approach are typically used as secondary methodologies to test the reasonableness of the value derived from the Income Approach. In its simplest form, the Income Approach is based on the following formula:

Value = Net Operating Income (NOI) / Overall Capitalization Rate (Cap Rate)

The correct application of the Income Approach requires matching a stabilized NOI estimate with a corresponding cap rate. Changing either of these variables results in a change in the value of the property, as shown below:

Property Value Increases when: a) NOI increases; and/or

b) Cap rate decreases.

Property Value Decreases when: a) NOI decreases; and/or

b) Cap rate increases.

Investors often make the mistake of thinking the cap rate and NOI are two independent variables that can be estimated in isolation of one another. In reality, the relationship between the two is a complicated one. For example, a capital expenditure, like a new roof, might enhance the economic life of a building although it may do little to increase rents. If the NOI doesn’t change as a result of the new roof, does that mean the property’s value doesn’t change either? In all likelihood the cap rate would be adjusted downward to reflect the incremental value added by the new roof, but by how much should the cap rate be adjusted downward?

How do I calculate the present value of the retrofit costs?

It seems simple enough—add up the all invoices and voila, there’s the total cost of your renovation project. Calculating the true cost of a renovation project, however, may involve further considerations:

- Are there any financial incentives being offered by government or industry that can potentially offset your up-front costs? Are these incentives paid in a lump-sum up-front payment or are they received over time in future years?

- Have you included a management fee to reflect your time and expertise in executing the renovation project (i.e. obtaining permits, obtaining quotes, hiring trades, managing trades, etc.)?

- Has lost rent throughout the renovation project been accurately accounted for?

To renovate or not: A simplified case study

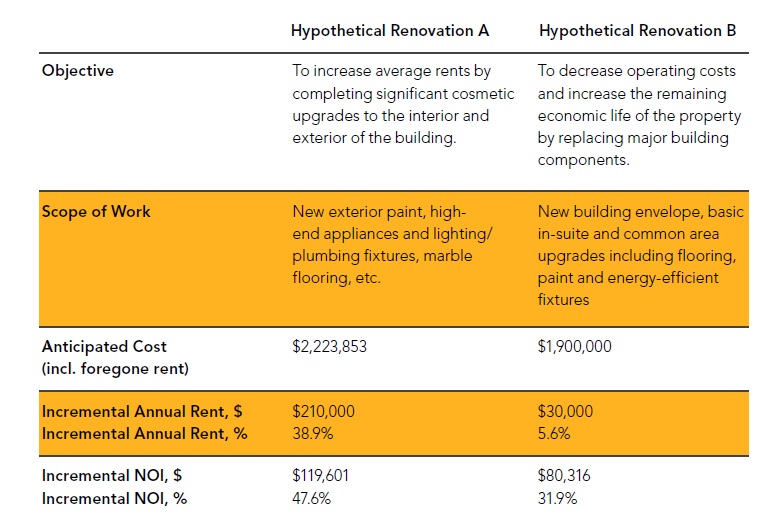

Let’s assume you own a 50-unit apartment building built in the 1960s. The property has an excellent location and despite dated interior and exterior finishings, the property has operated at full occupancy in recent years. You are currently debating completing one (or neither) of the following renovation projects:

You have researched your property’s competitive positioning within its market and based on this analysis, and the scope of each retrofit project, you have estimated Hypothetical Retrofit A will result in greater incremental annual rent and NOI, albeit at a slightly higher anticipated cost. What should you do? Some (but far from all) of the considerations you should keep in mind include:

- Are there rent controls that may limit how much and when you can increase rents?

- How will your property assessment, and hence property taxes, be impacted?

- How will your property’s post-retrofit average rent and operating costs compare to the broader market?

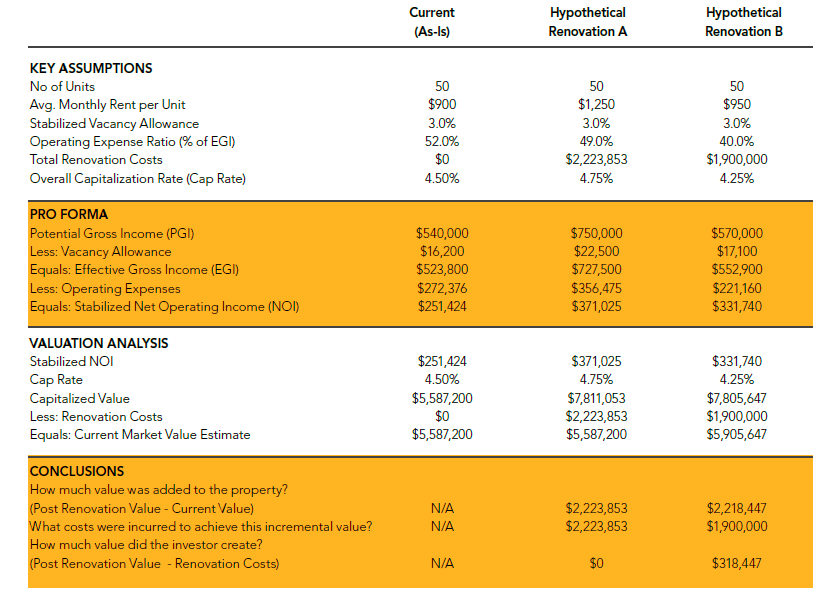

The following analysis compares the property’s current ‘as-is’ value against its ‘as-renovated’ value based on Renovation A and B. Note the average rents and operating costs are different in each scenario, as is the cap rate. In short, a higher cap rate for Renovation A reflects the added risk of targeting the small ‘high-end’ segment of the market whereas the cap rate for Renovation B accounts for the relative safety of having rents at current market levels, plus the expectation of no major capital expenditures over the near term.

Both Renovation A and B increase the value of the property but only Renovation B results in an increase in value. In other words, the value added to the property in Renovation A equals the cost of Renovation A, meaning there is no excess cash (profit) left for the investor (assuming no fees are included in the renovation cost). Would you invest $100 to receive $100 in return? Probably not.

On the other hand, Hypothetical Renovation B created over $300k in value. Should the investor undertake this project? What if the investor created $200k in value, should he or she still undertake this renovation project? The answer to this question depends on internal factors specific to the property and external factors related to the broader market. In the end, spreads between cost and value provide investors with opportunities to make profitable investment decisions. Understanding how and why cost and value may be different is, in large part, what differentiates successful investors from the rest.

JT Dhoot is a Chartered Business Valuator (CBV) and Accredited Appraiser (AACI) with over 10 years’ experience in valuations, real estate development, and private equity. He can be reached by email at jt@omnisvaluations.com, or by visiting his website: www.omnisvaluations.com

Interesting post with statistics on apartment renovations. Thanks for writing and sharing this post with us.