Above average transaction volumes, persistent demand and foreign capital have been driving Canada’s commercial investment property market in 2017, according to a recent report issued by Morguard Corporation.

The abundance of capital available for investment, in combination with the overall attractiveness of the market, is resulting in multiple-bid scenarios and higher prices. Consequently, there is downward pressure on yields, particularly regarding Canada’s premium assets. Modest price increases are expected to persevere for the near-term.

While the Canadian market may appear small on the international stage, it is garnering significant attention from international investors. Investment volume hit a record high in 2016 and foreign capital continues to support above-average transaction volumes and prices. There are risks to the market, which include the new U.S. administration’s protectionist threat, possible interest rate hikes, a potential prolonged commodities slump and the knock-on effects of a breakup of the European Union. Despite these, in Canada, demand for commercial real estate continues to outstrip the supply.

“We see the current phase of the commercial real estate as durable,” said Keith Reading. “Canada’s federal budget contained few surprises. The national inflation rate was unchanged for the (first) quarter and our continued confidence in the U.S. economy lead us to believe that current market conditions for commercial real estate will remain supportive for the foreseeable future. In this environment, investors will look to enter into forward purchases, and pursue creative development and redevelopment opportunities.”

Despite peak pricing levels, investors continue to target purpose-built multi-suite rental properties across the country. Low interest rates and easy access to debt and equity capital are driving investment activity.

“Some investors are turning to forward purchases and development as sources of core investments,” said Reading. “Yields are holding at record lows for assets in prime locations. Investment demand continues to outdistance the supply of assets available for acquisition in major markets.”

Reading also notes that development activity will continue to increase in the coming year, but oversupply risk is low.

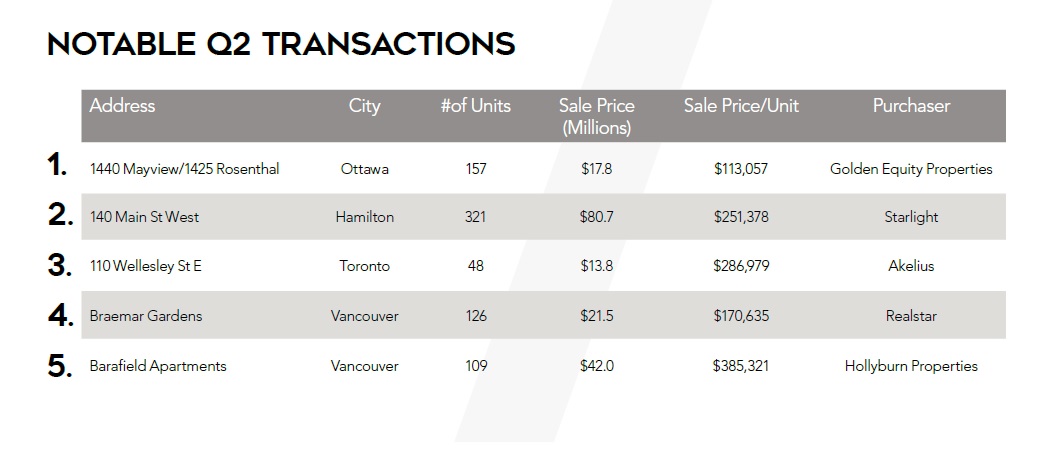

Notable Q2 apartment transactions: