Nearly one in five Canadians have serious home-buying intentions for this year. A new Wahi survey of Angus Reid Forum members looked at ownership prospects for 2024 and found people under 35 are the most determined group.

The survey, conducted between December 14 and 18, 2023, also analyzes what Canadians are going to do to make their ownership dreams come true, suggesting that many are planning to make sacrifices, including spending less, working longer hours, or taking on a side hustle.

“As the results of our survey suggest, many Canadians are planning to purchase a home this year — particularly in some of the country’s more affordable markets — and they’re also willing to make lifestyle and work changes to realize their dreams,” says Wahi CEO Benjy Katchen.

Here are some key findings from the survey:

1. Despite high house prices and the recent surge in interest rates, nearly one-quarter (24 per cent) of Canadians aged 18-34 say they might, or probably will, buy a home in 2024. This is higher than what was observed for those aged 35-54 (22 per cent) and 55 plus (11 per cent). The national average for all age groups was 18 per cent.

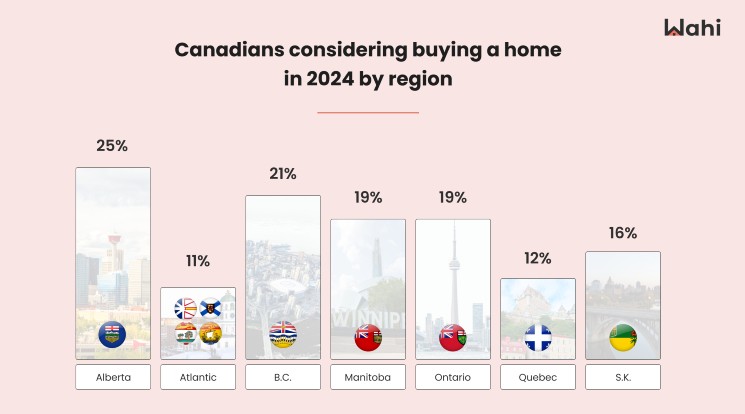

2. Alberta has the highest proportion (25 per cent) saying they may buy a home next year, possibly reflecting the affordability of Calgary and Edmonton compared to other major Canadian cities. In B.C. and Ontario, the provinces with the highest home prices, 21 per cent and 19 per cent of respondents, respectively, may buy a home next year. Atlantic Canada had the lowest share of potential homebuyers (11 per cent) but the highest share of existing homeowners who say they own a home and are not looking to buy now.

3. Among Canadians who say they might, or probably will, buy a home in 2024, the top potential barriers are that they want to see what happens with home prices and interest rates. More than a quarter of these respondents aren’t sure if they have enough savings, especially those residing in B.C. (36 per cent), Atlantic Canada (34 per cent), Ontario (29 per cent).

4. Forty-five per cent of potential homebuyers say they are cutting back on spending to set themselves up financially for purchasing a home in 2024, making it the most common sacrifice (respondents could choose multiple answers). Canadians aged 18 to 34 were most likely to cut back on spending (59 per cent).

Canadians also say they are planning to work more hours (21 per cent) or take on a gig-economy job, such as driving for Uber (8 per cent). About one in five potential homebuyers aged 18-34 plan to purchase property with a partner or family member to split the cost.