Avison Young released its fourth-quarter 2016 Real Estate Investment Review of the Greater Toronto Area, reporting that 2016 multi-res sales declined by 39 per cent. More broadly, the GTA saw office, industrial, retail, multi-residential and ICI land property sales decline by 12 per cent quarter-over-quarter to $2.8 billion, as the office and land sectors delivered lower sales volumes. However, propelled by marquee office sales that provided stand-out results in the second and third quarters of the year, GTA-wide sales increased 12 per cent year-over-year in 2016 to $11.8 billion – an all-time record-high result.

According to the report, foreign investor interest was prominent in 2016 and will endure in 2017, putting pressure on established domestic buyers, while demand will likely continue to outpace supply, keeping yields at historic lows.

Commanding the lowest yields, multi-residential sales increased 93 per cent quarter-over-quarter to $290 million (10 per cent share). However, the annual total of nearly $1.2 billion represented a 39 per cent decline compared with 2015’s $1.9-billion high-water mark for the decade to date, as investors were held back by an inadequate supply of product. Nonetheless, the $57-million purchase of Vantage Towers (a 329-unit complex in North York) by Minto Group was the largest transaction of the quarter and year in this sector.

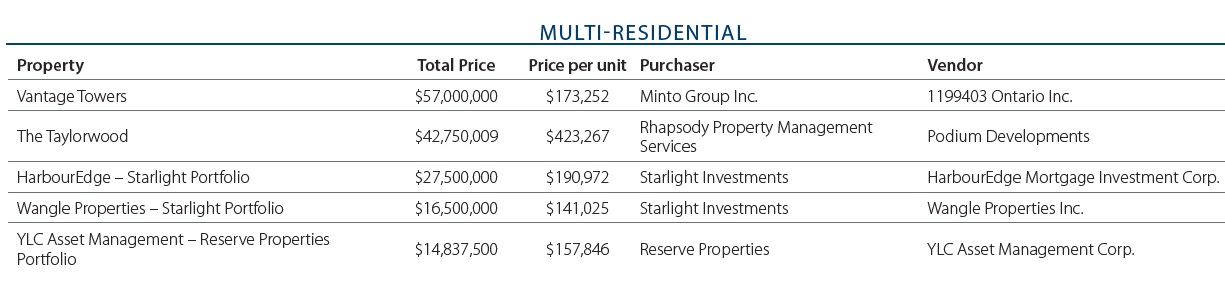

Top 2016 multi-res sales in the GTA included the following: